Getting Started with a Two-Sided Market Business

As I discussed in Matching Algorithm, I end up talking to a lot of startups who want to become the eHarmony of careers, eHarmony of clothes, eHarmony of jobs, eHarmony of tutoring, eHarmony of services, eHarmony of investments, etc. This comes up a lot and if you are thinking about one of these kinds of startups, definitely take a look at Matching Algorithm.

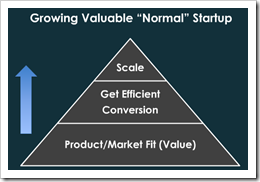

When I talk to the founders of one of these “eHarmony of” companies, one of the hardest problems is how to predict and test the concept in the early days – before you have scale. Sean Ellis in Bringing a Network Effect Business to Market positions this via the following two pictures:

In the case of a normal startup, you can launch an MVP and keep optimizing from there to achieve scale. In a Network Effect Startup, you need to drive growth to some degree in order to be able to even begin to test it. And to get growth you need some level of efficient conversion. So, it makes it much harder to predict, test and scale a network effect startup.

Let’s take a particular example: eHarmony of jobs.

In this case, the system will be made up of a classic two-sided market:

- Job Seekers

- Jobs / Employers

And like most two-sided markets, the value to either side is most often proportional to the number of users on the network’s other side. I.e., a job seeker would get more value if there are lots of jobs / employers. An employer gets value if there are lots of job seekers.

The problem for an early stage startup is that without critical mass, the system doesn’t provide much value. Coming back with no matches is not a very satisfying result and you generally will lose customers that you may have even paid to acquire.

Before you determine your specific strategy a few questions to think through:

A. Do you need real-time response? Do you have time to manually find matches? Who would be willing to wait? How long?

B. How hard is it to find matches on either side? What can be done using information that already exists? How is it done today? What’s the cost of doing it?

C. What are the economics? Who pays? How hard is it to acquire each side? Can you effectively subsidize one or both sides initially?

D. What do you really need to prove? Is it sufficient to show some level of matching and that there are willing buyers?

E. What kinds of tests can I run to simulate and prove aspects of this?

From there, you might consider some specific strategies.

Limit the Scope

Trying to launch the eHarmony of jobs all in one shot would be very challenging. Instead, you should think about how you can effectively limit the scope. Let’s only go after this particular type of worker and this type of job/employer. Let’s limit ourselves to this geography. By doing so, you definitely constrain the problem, but it doesn’t strictly go away. It’s just that you now need to prove whether you can achieve critical mass in a limited scope.

Jason Cohen has a great line about this in Solving the “marketplace” business model:

If you’re bootstrapping and your value proposition includes the words “anything” or “anyone,” you’re probably reaching too far.

Make sure your value proposition works when it’s a limit inventory – ideally on both sides. So, if the job seeker expects to find “every” available job, you likely have a problem. Or if the employer expects to have every possible employee – that’s a problem. What you really want are well matched on either side, not necessarily the absolute best from the universe of all possibilities.

Quick Growth

Let’s say you’ve limited it to a particular type of job in a specific geography. Well chances are there are some partners or sites where you can get information on jobs today. There likely are partner lists that you could hit up to quickly achieve growth.

Go Manual Behind the Scenes

Do you really need to be real-time in your response? In the case of jobs, you can probably get away without being real-time on either side. In other words, someone puts in their information and two days later you come back with a list of potential matches.

What this allows is one of the more common early approaches for startups. Basically you do things manually at the start. Likely there is lots of job information already available. Maybe you are simply doing smart searches on behalf of job seekers and coming back with those job suggestions. Or for each job that you get from an employer, you comb through social networks, LinkedIn, etc. to source potential candidates. Or both.

In fact, if you do both, it’s called a Zig-Zag strategy.

A really great example of this is described by Steve Rentoid in Inventing Demand. He wanted to build a business that rented electronics. So, he would determine what people might want. He would put up ads. And then:

When people rented the items, I went out and bought them, first hunting for the lowest price on line. Then rented it to the new rentoid member in good faith and gave them an exceptional user experience. After the rental I sold the item on eBay for around about 80% of the retail price. I pretty much re-couped my costs doing this.

Jason Cohen also recommends this in Solving the “marketplace” business model:

But just because automation is the goal doesn’t mean it’s the way to start. The good thing about automation is it’s efficient; the bad thing is you cannot learn because you’re not involved in the process. And at the start, learning is where you should be spending most of your time!

Create Network Independent Value

Provide a job seeker some kind of profile that would be of value to them independent of finding a job. Provide an employer a low-cost, free way for them to manage their recruiting efforts. I.e., they get an SAS recruiting solution that allows them to post jobs and manage the recruiting process.

Additional Reading

Some additional resources. I’d love to hear about others:

- The “ladies’ night” strategy

- Six strategies for solving the Chicken or the Egg Problem

- The “thin edge of the wedge” strategy

- Market building dilemma

- Two-Sided Markets: Which Side First?

- Two-Sided Markets: Density

- Strategy Letter on Chicken & Egg Problems

I definitely plan to blog more about this topic as it comes up quite often.